IMDX Reports Q3 2025 Results and Progress Toward 2026 Commercial Launch

- On track to submit GraftAssureDx™ for FDA review by year-end

- On track for commitment to have 20 transplant centers globally engaged with GraftAssure technology by end of 2025

- GraftAssure assay’s head-to-head data continue to be favorable

- Preparing to rapidly expand beyond kidney into heart transplant testing

NASHVILLE, Tenn., Nov. 10, 2025 (GLOBE NEWSWIRE) -- Insight Molecular Diagnostics Inc., or iMDx, (Nasdaq: IMDX), today published the following letter to shareholders in conjunction with its third quarter results:

Fellow shareholders,

There is a palpable level of excitement and activation energy coursing through our company as we prepare to submit our application for approval of our first molecular diagnostic test kit for clinical use, GraftAssureDx™, to the FDA. We expect to begin selling the product next year after we achieve regulatory marketing authorization.

We are grateful to you all for your financial support. Over the past three years, it has allowed us to achieve one milestone after another. We remain laser-focused on delivering our first kitted clinical product to the transplant market. Over time, we believe this product will create value and improve care for transplant patients. As you probably recall, GraftAssureDx builds on the foundation of our other transplant tests that use the same digital PCR-based technology -- our GraftAssureCore™ lab-developed test that is performed in our own CLIA lab in Nashville, and our GraftAssureIQ™ test kit that is for research use only.

As a quick recap, iMDx seeks to deliver a best-in-class molecular diagnostic test kit for clinical use that expands and improves access to organ health testing for kidney transplant patients. We expect that enabling localized testing will deliver new value in the roughly $1 billion-plus addressable market for kitted transplant rejection testing. We believe that regulatory clearance will enable us to gain a foothold in the market, after which we expect to begin to dramatically scale our business quarter by quarter. We expect this progress will enable us to surpass our near-term financial objectives, generate sustained free cash flow, and head towards $100 million in annual high-margin revenue growing at a double-digit pace.

The molecular diagnostic technology market is ripe for disruption by kitted assays. This is particularly true in the organ transplant category, where most molecular diagnostics companies have pursued a centralized lab services model that is cost-intensive and difficult to scale. In contrast, we are pursuing a decentralized approach that brings testing closer to patients and transplant centers. To do this, we have made a significant investment to design a kitted form of a transplant rejection testing assay (a scientific feat of product engineering in and of itself). We are now in the process of obtaining regulatory clearance to sell our test kits as a regulated medical device, and we believe that the availability of our test kit will significantly improve transplant patient care.

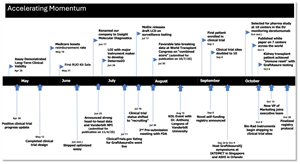

Accelerating Momentum and Upcoming Catalysts:

We believe our momentum is accelerating, and we are looking forward to a series of catalysts in the coming weeks and months – including:

- our data submission to the FDA,

- the official launch of our registry study and the validation of what could be industry-leading positive predictive values in transplant rejection testing,

- the publication and display of additional favorable head-to-head study data,

- and milestones associated with our expansion into transplant tests for hearts, among other organs.

We believe that the registry referenced above will allow us to drive clinician engagement with our assay. As a reminder, the Centers for Medicare & Medicaid Services (CMS) issued a positive coverage decision for our test in August 2023, and since then, expanded coverage to include our test for organ rejection surveillance in certain high-risk transplant patients. In May 2025, CMS improved its reimbursement price for our assay to $2,753 per result.

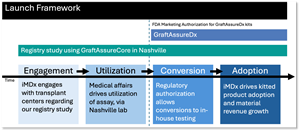

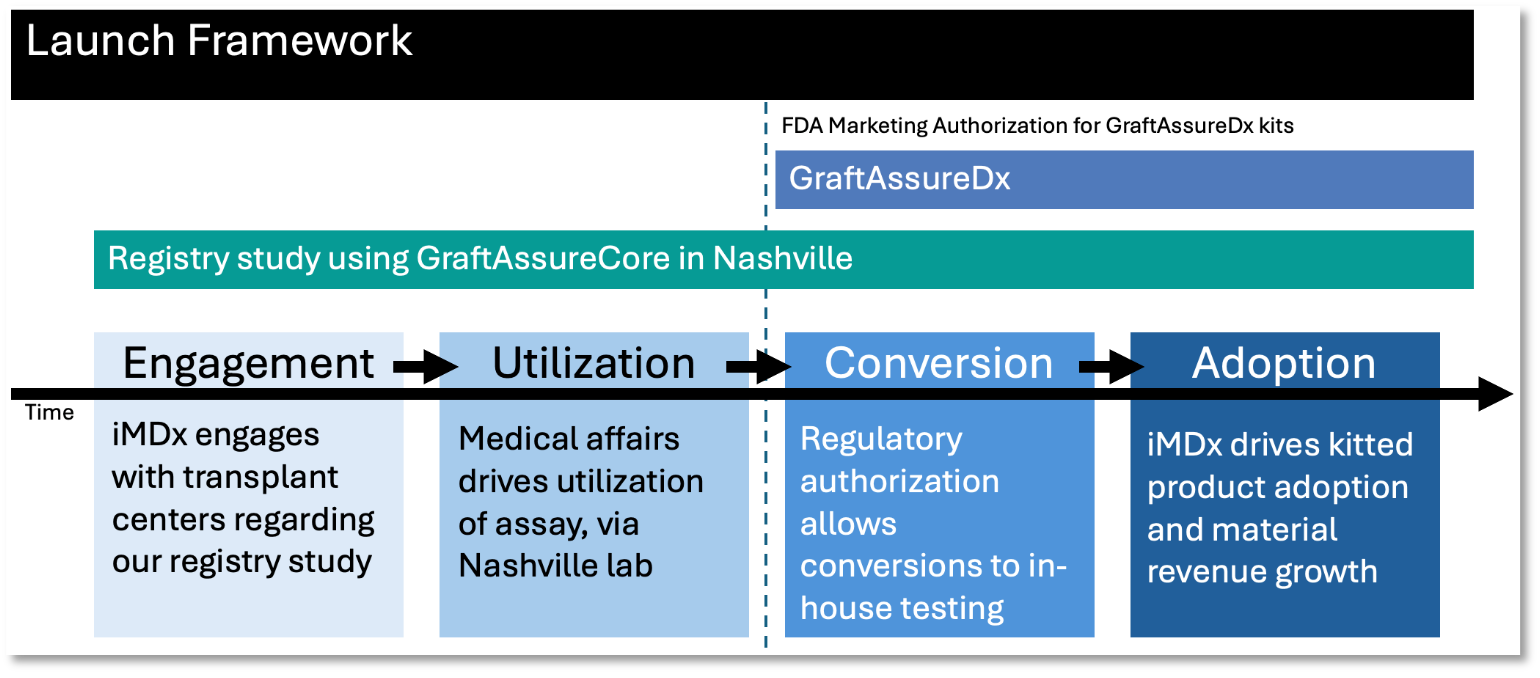

Meanwhile, we continue to focus on obtaining FDA marketing authorization for GraftAssureDx to be run locally at transplant centers. Our launch framework, through which we intend to drive engagement, utilization, and eventually the conversion and adoption of our kits, is presented visually in the “Launch Framework” graphic shown below.

A Walkthrough of the Components of our FDA Submission

As first communicated in March, we remain on track to submit GraftAssureDx to the FDA by the end of 2025. In line with our commitment to be transparent about execution and accountability, as we prepare for our submission, we’d like to provide you with a thorough explanation of the work streams orchestrated this year.

Submitting a diagnostic test to the FDA for marketing clearance is a rigorous, detail-intensive process, and we’re fortunate to have very seasoned team members who have successfully led such submissions at other companies.

1. FDA-compliant software development and validation for GraftAssureDx: We are finalizing development and validation of the GraftAssureDx software in compliance with the regulatory standards for in vitro diagnostic (IVD) devices. Provided that our vendor delivers as committed, we expect to achieve software readiness to support the FDA filing before year-end.

2. Clinical trial site sample collection and processing: We now have 11 sites participating in our clinical trial, with Vanderbilt University Medical Center, Tampa General Hospital, and Cleveland Clinic already actively collecting samples. In addition to collecting clinical samples, each clinical trial site is expected to complete testing and the associated documentation required for inclusion in our regulatory submission. We intend to continue to collect clinical trial samples beyond year-end to support ongoing and future studies, and in preparation for potential FDA reviewer follow-up questions, which are common.

3. Reproducibility work: This workstream includes repeatability and reproducibility testing necessary to demonstrate analytical performance and consistency of results across labs, days, instruments, operators, reagent lots, and assay runs. We are pleased to report that all underlying materials, protocols, and data review workflows are in place at our reproducibility participant sites.

4. GraftAssureDx kitted product development and design: Earlier this year, we finalized the kitted product design for the GraftAssureDx assay, including all components, labeling, instructions for use, and manufacturing readiness documentation. Our kit configuration and design are locked down. We are now finalizing the design verification and validation phase and this workstream is nearly complete.

5. Quality assurance system development: Part of any diagnostic design includes all of the work that goes into quality assurance, including the establishment and implementation of a comprehensive quality management system that meets both FDA 21 CFR Part 820 requirements as well as the ISO 13485 international standard for medical devices. We worked from the outset to ensure that all design controls, documentation practices, and production processes aligned with the standards and regulations.

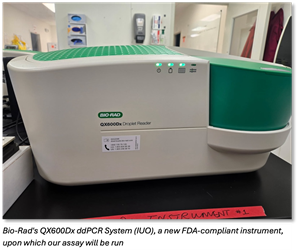

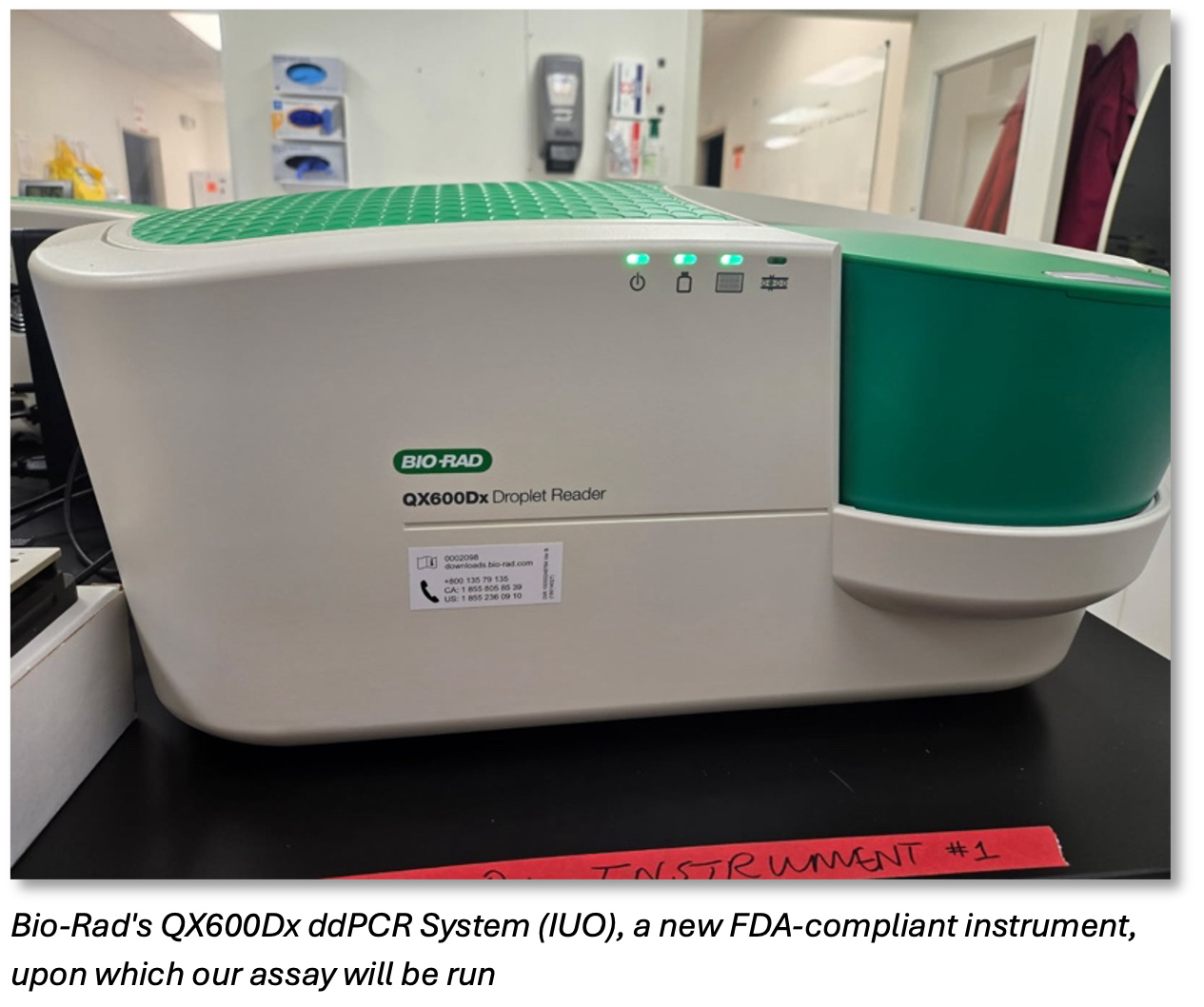

6. Bio-Rad's supply of instrumentation and certain reagents: A major part of our GraftAssureDx development has been in conjunction with and is reliant upon our strategic partner, Bio-Rad Laboratories, which provides the instrumentation and certain reagents critical to the GraftAssureDx workflow. Bio-Rad’s reliability and current project cadence support our year-end submission.

A final note about timelines:

There could be delays to our timeline because of the federal government shutdown that is outside of our control. Of note, our assigned reviewer at the FDA has been working through the government shutdown even though the FDA’s Center for Devices and Radiological Health paused acceptance of new device submissions. We have previously communicated that we expected the FDA review to be completed by about mid-2026, which allowed room for the FDA to ask us questions and for us to submit answers. We are still preparing for a mid-2026 product launch. Importantly, the government shutdown should not affect our ability to drive engagement with customers and utilization of our assay at our Nashville CLIA lab.

Since our August 11 shareholder letter, we have made diligent progress toward our long-term objectives. To highlight a few:

1) Successful and informative Key Opinion Leader event: On August 15th, we hosted a webinar with our national principal investigator, Dr. Anthony J. Langone of Vanderbilt University Medical Center. During the event, Dr. Langone spoke about our GraftAssure family of products and emphasized the added clinical value they can bring to the transplant community. His complimentary remarks reinforced the strength of our scientific approach and the growing enthusiasm among clinicians for our technology. (Listen to the replay.)

2) We signed two research customers in Europe, putting us well within reach of our goal to have 20 transplant center labs using GraftAssure technology: Through our GraftAssureIQ research-use-only pilot program, with research hospitals leveraging our assay to perform studies, or through our clinical trial, with transplant center labs running our assay to support our data submission to the FDA, we are approaching our goal of having 20 transplant centers familiar with our technology by the end of this year. We are not stopping – we intend to drive continued engagement through our registry study and GraftAssureIQ. To recap, we now expect at least 11 centers to participate in our clinical trial and we have 12 centers that are performing research with GraftAssureIQ. Four of those institutions overlap – and are performing research using GraftAssureIQ and separately participating in our clinical trial for GraftAssureDx, bringing the total to 19.

3) Customer interest continues to exceed expectations: In September, we showcased strong customer engagement and global interest in our technology at two major scientific meetings – the International Association of Therapeutic Drug Monitoring and Clinical Toxicology (IATDMCT) conference in Singapore and the American Society for Histocompatibility and Immunogenetics (ASHI) annual meeting in Orlando. Across both events, clinicians and partners spoke enthusiastically about the potential of our GraftAssure assays to enable in-house transplant testing, and we estimate that nearly 100 ASHI attendees, or about 10% of that conference, joined our symposium -- a strong indicator of the growing visibility and impact of iMDx’s work in kidney transplant management.

4) Registry kick-off expected to drive early 2026 customer engagement: On September 8th, we announced a major strategic initiative: our 5,000-participant, multi-center registry program designed to strengthen and expand our transplant testing platform. The registry is designed to generate real-world data across approximately 50 transplant centers, collecting an estimated 50,000 samples in up to six years. This hospital-based real-world dataset is expected to further differentiate our pending kitted assay by validating the clinical utility of our novel combined dd-cfDNA score and assessing the “Berlin protocol,” an accelerated monitoring approach for high-risk patients.

5) More transplant centers joined GraftAssureDx clinical trial: Also on September 8th, we were thrilled to announce that our ClinicalTrials.gov listing had expanded to 10 leading transplant centers, up from five previously, reflecting strong engagement from the clinical community. And in recent days, we welcomed our 11th participant. As a reminder, the study is designed to validate that the GraftAssureDx kitted assay accurately assesses kidney transplant rejection. (Investors may read more about our clinical trial (NCT07060716) here: Validation of Donor-Derived Cell-Free DNA (Dd-cfDNA) for Kidney Transplant Monitoring).

6) New VP Marketing joins iMDx executive team: In late September, we welcomed Steven Tahmooressi to our executive leadership team as Vice President of Marketing to lead global marketing for the GraftAssure family of assays and future products. With more than 25 years of experience at Astellas, Abbott, and Bristol-Myers Squibb, Steven brings deep expertise in transplantation, oncology, and immunology, along with a proven record of driving new product adoption across global markets. His appointment comes as we prepare for expected FDA authorization and the anticipated 2026 launch of our first clinical kitted assay, GraftAssureDx. Steven has already hit the ground running, including meeting with customers and supporting our successful presence at the ASHI annual meeting in Orlando.

7) GraftAssure assay enabled novel approach to kidney transplant rejection management: In October, we announced results published in the American Journal of Transplantation showing how GraftAssure was used to monitor a kidney transplant patient who developed lymphoma and was treated with novel CD19 CAR-T therapy. Our assay confirmed the absence of rejection during treatment, allowing doctors to avoid overtreatment and preserve the patient’s immune system. The patient maintained stable graft function and remained in remission for about two years, suggesting an “immune reset.” This study adds to a body of research that may position GraftAssure as potentially essential in managing kidney transplant patients, and points to growing clinical use cases over time. Transplant care is evolving to include novel therapies, and we believe that the need for ongoing molecular diagnostic monitoring technology like GraftAssure will continue to grow.

8) Bio-Rad’s QX600Dx ddPCR System (IUO) instruments shipping to clinical trial sites: During the week of October 9th, we reached a major operational milestone with the release of our first batch of diagnostic kits and the arrival of our initial Bio-Rad QX600Dx ddPCR System (IUO) instruments in-house. Our lab in Nashville was buzzing with activity as new reagents and equipment arrived, which will help bolster the supplies at our clinical sites. We also welcomed a new scientist to the team, who immediately began contributing to the growing momentum behind our clinical readiness.

In summary, we have a lot to look forward to as we close out the year and head into 2026. Our clinical sites are engaged, and we expect that our registry will expand quickly.

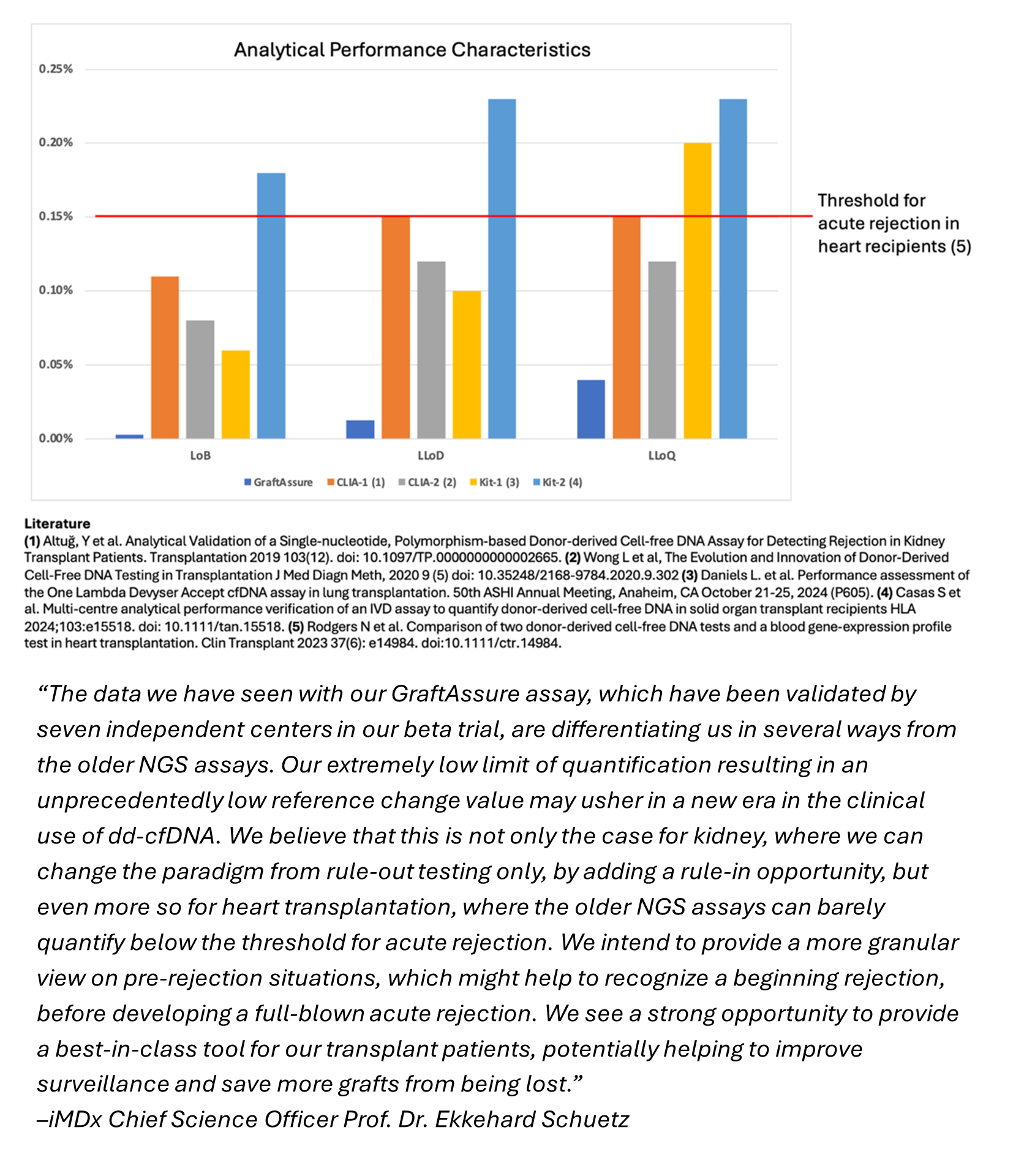

Our next development programs – including molecular diagnostic tests for heart and lung transplants – are moving through validation in our CLIA lab in preparation for submitting CMS coverage dossiers, which we believe should set the stage for reimbursement and broaden our reach across transplanted organ types. We are especially excited about our prospects for expanding into heart transplant rejection testing, where our early data strongly indicates the potential that GraftAssureDx may be the best-in-class diagnostic. Please see the adjacent chart and quote from our Chief Science Officer for additional details regarding the use of our GraftAssure assay to detect acute rejection in heart transplant recipients.

With strong momentum in both the U.S. and abroad, growing recognition of our assay’s performance, and continued progress toward FDA submission, we look forward to sharing more updates as iMDx continues to deliver on its mission.

- The iMDx Management Team

Q3 2025 Financial Overview

- Our reported revenues of $260,000 in Q3 2025 were derived from laboratory services performed at our clinical laboratory in Nashville.

- Relative to our strategic goal of selling diagnostic test kits for clinical use, we remain essentially “pre-revenue.”

- Our laboratory services are performed at the request of select clients, and we see our laboratory services revenue as a testament to our team’s ability to achieve the on-time delivery of clear, scientifically sound, and accurate data sets to our clients.

- We did not realize any kitted product revenue in the third quarter. As previously communicated, we do not expect material revenue on our kitted product sales until after we have achieved regulatory clearance to market GraftAssureDx.

- We reported gross profit of $139,000 in Q3 2025, representing a 53.5% gross margin.

- In Q3 2025, operating expenses of $11.2 million included $3.4 million in a non-cash change in the fair value of our contingent consideration, as well as $521,000 in non-cash stock-based compensation expenses and $563,000 in non-cash depreciation and amortization expenses. Excluding the impact of these non-cash charges, operating expenses increased 6% sequentially over the second quarter, as we invested more heavily in our FDA program ahead of commercial launch, while finding offsets among general and administrative expenses and realizing fewer sales and marketing expenses in the quarter.

- Research and development expenses increased 18% sequentially to $3.9 million in the third quarter reflecting increased investment in our kitted product development – including FDA-compliant software development expenses, laboratory supplies, kit production, personnel and regulatory consulting fees.

- Sales and marketing expenses declined 5% sequentially to $1.4 million in the third quarter. We continue to invest in go-to-market activities as we prepare for commercial launch, including marketing, advertising, travel and personnel.

- General and administrative expenses declined 4% sequentially to $2.5 million in the third quarter, driven by cost discipline.

- Our Q3 2025 net loss was $10.9 million, or ($0.34) per share.

- Our Q3 2025 non-GAAP loss from operations was $6.6 million, which excludes non-cash items, including stock-based compensation, depreciation and amortization and contingent consideration fair value changes. Starting in 2026, we will retire our non-GAAP loss from operations disclosure and introduce Adjusted EBITDA.

- We also intend to introduce adjusted net loss and adjusted EPS tables, both of which will also exclude certain non-cash items similarly to the non-GAAP loss from operations adjustments above.

- Please refer to the table below, “Reconciliation of Non-GAAP Financial Measure,” for additional information.

- Our Q3 2025 per share results reflect 32.0 million weighted average shares outstanding and include the effects of 3.4 million pre-funded warrant shares that were issued in April 2024 and February 2025 to a certain investor.

- Our cash, cash equivalents, and restricted cash balance at the end of the third quarter was $20.2 million.

- We are pleased that our third quarter outgoing cash flow from operations (net cash used in operating activities) of $4.6 million, combined with capital expenditures of $1.1 million, were favorable to our targeted quarterly average spend of $6 million. This was partially a result of operational efficiency and partly a result of working capital management and the timing on expenses related to our FDA program. We expect Q4 2025 expenses to fluctuate above $6 million as we make incremental investments into our FDA program, some of which are short-term in nature and can be scaled down if desired after our FDA submission.

Webcast and Conference Call Information

Live Zoom Call and Webcast on Monday, November 10, 2025, at 2:00 p.m. PT / 5:00 p.m. ET.

Those interested may access the live Zoom call by registering here: iMDx Q3 Earnings Registration Link

Once registered, a confirmation email will be sent with instructions.

A replay of the Zoom call will be available on the company’s website shortly after the call.

About Insight Molecular Diagnostics, Inc.

Insight Molecular Diagnostics is a pioneering diagnostics technology company whose mission is to democratize access to novel molecular diagnostic testing to improve patient outcomes. Investors may visit https://investors.Insight Molecular Diagnostics.com/ for more information.

GraftAssureCore™, GraftAssureIQ™, GraftAssureDx™, VitaGraft™, GraftAssure™, DetermaIO™, and DetermaCNI™ are trademarks of Insight Molecular Diagnostics Inc.

QX600Dx is a trademark of Bio-Rad Laboratories, Inc.

Forward-Looking Statements

Any statements that are not historical fact (including, but not limited to, statements that contain words such as “will,” “believes,” “plans,” “anticipates,” “expects,” “estimates,” “may,” and similar expressions) are forward-looking statements. These statements include those pertaining to, among other things, the Company’s plans to submit GraftAssureDx for FDA review by year-end, the anticipated rapid expansion beyond kidney into heart transplant testing, sales and cash flow/revenue projections, commercialization strategy, ongoing clinical trial, FDA submission progress, and other statements about the future expectations, beliefs, goals, plans, or prospects expressed by management. Forward-looking statements involve risks and uncertainties, including, without limitation, risks inherent in the development and/or commercialization of diagnostic tests or products, uncertainty in the results of clinical trials or regulatory approvals, the capacity of Insight Molecular Diagnostics’ third-party supplied blood sample analytic system to provide consistent and precise analytic results on a commercial scale, potential interruptions to supply chains, the need and ability to obtain future capital, maintenance of intellectual property rights in all applicable jurisdictions, obligations to third parties with respect to licensed or acquired technology and products, the need to obtain third party reimbursement for patients’ use of any diagnostic tests Insight Molecular Diagnostics or its subsidiaries commercialize in applicable jurisdictions, and risks inherent in strategic transactions such as the potential failure to realize anticipated benefits, legal, regulatory or political changes in the applicable jurisdictions, accounting and quality controls, potential greater than estimated allocations of resources to develop and commercialize technologies, or potential failure to maintain any laboratory accreditation or certification. Actual results may differ materially from the results anticipated in these forward-looking statements and accordingly such statements should be evaluated together with the many uncertainties that affect the business of Insight Molecular Diagnostics, particularly those mentioned in the “Risk Factors” and other cautionary statements found in Insight Molecular Diagnostics’ Securities and Exchange Commission (SEC) filings, which are available from the SEC’s website. You are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they were made. Insight Molecular Diagnostics undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

Investor Contact:

Doug Farrell

LifeSci Advisors LLC

dfarrell@lifesciadvisors.com

INSIGHT MOLECULAR DIAGNOSTICS INC.,

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

| September 30, 2025 |

December 31, 2024 |

|||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash and cash equivalents | $ | 18,692 | $ | 8,636 | ||||

| Accounts receivable, net of allowance for credit losses of $3 and $16, respectively | 258 | 1,613 | ||||||

| Inventories | 471 | 410 | ||||||

| Deferred financing costs | — | 279 | ||||||

| Restricted cash, current | 729 | — | ||||||

| Prepaid expenses and other current assets | 1,239 | 821 | ||||||

| Total current assets | 21,389 | 11,759 | ||||||

| NONCURRENT ASSETS | ||||||||

| Right-of-use and financing lease assets, net | 2,340 | 2,757 | ||||||

| Machinery and equipment, net, and construction in progress | 4,147 | 3,567 | ||||||

| Intangible assets, net | 14,600 | 14,607 | ||||||

| Restricted cash, noncurrent | 789 | 1,700 | ||||||

| Other noncurrent assets | 672 | 691 | ||||||

| TOTAL ASSETS | $ | 43,937 | $ | 35,081 | ||||

| LIABILITIES AND SHAREHOLDERS’ DEFICIT | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable | $ | 1,056 | $ | 2,279 | ||||

| Accrued compensation | 2,228 | 1,939 | ||||||

| Accrued royalties | 1,120 | 1,116 | ||||||

| Accrued expenses and other current liabilities | 602 | 418 | ||||||

| Right-of-use and financing lease liabilities, current | 1,598 | 1,295 | ||||||

| Contingent consideration liabilities, current | 1,056 | 228 | ||||||

| Total current liabilities | 7,660 | 7,275 | ||||||

| NONCURRENT LIABILITIES | ||||||||

| Right-of-use and financing lease liabilities, noncurrent | 1,529 | 2,369 | ||||||

| Contingent consideration liabilities, noncurrent | 43,944 | 37,711 | ||||||

| TOTAL LIABILITIES | 53,133 | 47,355 | ||||||

| Commitments and contingencies | ||||||||

| SHAREHOLDERS’ DEFICIT | ||||||||

| Preferred stock, no par value, 5,000 shares authorized; no shares issued and outstanding | — | — | ||||||

| Common stock, no par value, 230,000 shares authorized; 28,625 and 17,453 shares issued and outstanding at September 30, 2025 and December 31, 2024, respectively | 368,524 | 338,244 | ||||||

| Accumulated other comprehensive income | 86 | 21 | ||||||

| Accumulated deficit | (377,806 | ) | (350,539 | ) | ||||

| Total shareholders’ deficit | (9,196 | ) | (12,274 | ) | ||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ DEFICIT | $ | 43,937 | $ | 35,081 | ||||

INSIGHT MOLECULAR DIAGNOSTICS INC.,

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Net revenue | $ | 260 | $ | 115 | $ | 2,916 | $ | 395 | ||||||||

| Cost of revenues | 121 | 43 | 1,107 | 184 | ||||||||||||

| Cost of revenues – amortization of acquired intangibles | — | 22 | 7 | 66 | ||||||||||||

| Gross profit | 139 | 50 | 1,802 | 145 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | 3,878 | 2,817 | 10,071 | 7,582 | ||||||||||||

| Sales and marketing | 1,386 | 1,043 | 4,052 | 2,742 | ||||||||||||

| General and administrative | 2,545 | 2,565 | 8,307 | 7,645 | ||||||||||||

| Change in fair value of contingent consideration | 3,378 | 7,140 | 7,061 | 9,421 | ||||||||||||

| Impairment loss on held for sale assets | — | — | — | 169 | ||||||||||||

| Total operating expenses | 11,187 | 13,565 | 29,491 | 27,559 | ||||||||||||

| Loss from operations | (11,048 | ) | (13,515 | ) | (27,689 | ) | (27,414 | ) | ||||||||

| Other (expenses) income: | ||||||||||||||||

| Interest expense | (29 | ) | (31 | ) | (83 | ) | (54 | ) | ||||||||

| Other income, net | 223 | 53 | 505 | 316 | ||||||||||||

| Total other income, net | 194 | 22 | 422 | 262 | ||||||||||||

| Loss before income taxes | (10,854 | ) | (13,493 | ) | (27,267 | ) | (27,152 | ) | ||||||||

| Income taxes | — | — | — | — | ||||||||||||

| Net loss | $ | (10,854 | ) | $ | (13,493 | ) | $ | (27,267 | ) | $ | (27,152 | ) | ||||

| Net loss per share: | ||||||||||||||||

| Net loss attributable to common stockholders - basic and diluted | $ | (10,854 | ) | $ | (13,493 | ) | $ | (27,267 | ) | $ | (27,415 | ) | ||||

| Net loss attributable to common stockholders per share - basic and diluted | $ | (0.34 | ) | $ | (0.98 | ) | $ | (0.91 | ) | $ | (2.36 | ) | ||||

| Weighted average shares outstanding - basic and diluted | 32,033 | 13,714 | 29,940 | 11,624 | ||||||||||||

INSIGHT MOLECULAR DIAGNOSTICS INC.,

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||||||||||

| Net loss | $ | (10,854 | ) | $ | (13,493 | ) | $ | (27,267 | ) | $ | (27,152 | ) | ||||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||||||||||

| Depreciation and amortization expense | 584 | 318 | 1,627 | 935 | ||||||||||||

| Amortization of intangible assets | — | 22 | 7 | 66 | ||||||||||||

| Stock-based compensation | 521 | 450 | 1,498 | 1,254 | ||||||||||||

| Equity compensation for bonus awards and consulting services | 38 | 14 | 126 | 110 | ||||||||||||

| Change in fair value of contingent consideration | 3,378 | 7,140 | 7,061 | 9,421 | ||||||||||||

| Impairment loss on held for sale assets | — | — | — | 169 | ||||||||||||

| Unrealized foreign currency losses | (18 | ) | 23 | 170 | 29 | |||||||||||

| Changes in operating assets and liabilities: | ||||||||||||||||

| Accounts receivable | 254 | (124 | ) | 1,355 | 275 | |||||||||||

| Inventories | 222 | (232 | ) | (61 | ) | (232 | ) | |||||||||

| Prepaid expenses and other assets | 129 | (315 | ) | (124 | ) | (353 | ) | |||||||||

| Accounts payable and accrued liabilities | 1,177 | 649 | (909 | ) | 263 | |||||||||||

| Operating lease assets and liabilities | (57 | ) | — | (122 | ) | (123 | ) | |||||||||

| Net cash used in operating activities | (4,626 | ) | (5,548 | ) | (16,639 | ) | (15,338 | ) | ||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||||||||||

| Machinery and equipment purchases, and construction in progress | (1,050 | ) | (87 | ) | (1,706 | ) | (302 | ) | ||||||||

| Net cash used in investing activities | (1,050 | ) | (87 | ) | (1,706 | ) | (302 | ) | ||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||||||||||

| Proceeds from sale of common shares | — | — | 29,143 | 15,807 | ||||||||||||

| Financing costs to issue common shares | — | — | (487 | ) | (538 | ) | ||||||||||

| Proceeds from sale of common shares under at-the-market transactions | — | 18 | — | 18 | ||||||||||||

| Financing costs for at-the-market sales | — | (187 | ) | — | (187 | ) | ||||||||||

| Redemption of Series A redeemable convertible preferred shares | — | — | — | (5,389 | ) | |||||||||||

| Repayment of financing lease obligations | (120 | ) | (86 | ) | (332 | ) | (119 | ) | ||||||||

| Net provided by financing activities | (120 | ) | (255 | ) | 28,324 | 9,592 | ||||||||||

| Effect of exchange rate changes on cash and cash equivalents | 19 | (3 | ) | (105 | ) | (21 | ) | |||||||||

| NET CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | (5,777 | ) | (5,893 | ) | 9,874 | (6,069 | ) | |||||||||

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, BEGINNING | 25,987 | 10,956 | 10,336 | 11,132 | ||||||||||||

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, ENDING | $ | 20,210 | $ | 5,063 | $ | 20,210 | $ | 5,063 | ||||||||

Insight Molecular Diagnostics Inc.,

Reconciliation of Non-GAAP Financial Measure

Consolidated Adjusted Loss from Operations

Note: In addition to financial results determined in accordance with U.S. generally accepted accounting principles (“GAAP”), this press release also includes a non-GAAP financial measure (as defined under SEC Regulation G). We believe that disclosing the adjusted amounts is helpful in assessing our ongoing performance, providing insight into the Company’s core operating performance by excluding certain non-cash, and / or intangible items that may obscure the underlying trends in the business. These non-GAAP financial measures, when viewed in a reconciliation to respective GAAP measures, provide an additional way of viewing the Company’s results of operations and factors and trends affecting the Company’s business. These non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the respective financial results presented in accordance with GAAP.

The following is a reconciliation of the non-GAAP measure to the most directly comparable GAAP measure:

| Three Months Ended | ||||||||||||

| September 30, | June 30, | September 30, | ||||||||||

| 2025 | 2025 | 2024 | ||||||||||

| (unaudited) | (unaudited) | (unaudited) | ||||||||||

| (In thousands) | ||||||||||||

| Consolidated GAAP loss from operations | $ | (11,048 | ) | $ | (9,842 | ) | $ | (13,515 | ) | |||

| Stock-based compensation | 521 | 504 | 450 | |||||||||

| Depreciation and amortization expenses | 584 | 559 | 340 | |||||||||

| Change in fair value of contingent consideration | 3,378 | 2,804 | 7,140 | |||||||||

| Consolidated Non-GAAP loss from operations, as adjusted | $ | (6,565 | ) | $ | (5,975 | ) | $ | (5,585 | ) | |||

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/88240988-f6f6-4836-800d-8cafbce7ace6

https://www.globenewswire.com/NewsRoom/AttachmentNg/d0472cca-141e-4a90-967b-33b24b72d963

https://www.globenewswire.com/NewsRoom/AttachmentNg/3cbda920-df3c-46e8-b317-4bf7911dadb8

https://www.globenewswire.com/NewsRoom/AttachmentNg/67f3cbab-ca06-45ac-abab-17a48ecf8ed6

https://www.globenewswire.com/NewsRoom/AttachmentNg/24d2f96e-6c23-46a0-bd36-e981a4625205

Figure 1

Accelerating Momentum

Figure 2

Launch Framework

Figure 3

Bio-Rad's QX600Dx ddPCR System (IUO), a new FDA-compliant instrument, upon which our assay will be run.

Figure 4

iMDx product development team members receiving a Bio-Rad QX600Dx ddPCR System (IUO), uponwhich our GraftAssureDx assay will be performed.

Figure 5

Analytical Performance Characteristics

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.